The S&P continued toward my target in the 1600 area, in fact I believe it hit the 1.618 Fibonacci move today and could retrace from here. Several indicators of that possibility. It is way beyond its upper Bollinger Band, it is possibly forming its third bearish divergence against the Ergodic momentum indicator, and it has touched and turned back at the top of the up channel as you can see in the chart. Another cautionary item to note is the non-confirmation by the Nasdaq 100 and the Russell 2000, neither making new highs here. Soooo I would make an educated guess that the market will find some reason to pull back from here. Now how big of a correction … I don’t know but May is right around the corner and statistically it has been wise to sell in May and go away. The market is setup for this classic traders almanac rule of thumb, to come true this year. On the other hand, the Fed is a long way from ending its QE so this market is in no way normal. In fact, its an example of the new normal.

Blog

Easter Egg Hunt

Here is my first attempt at home video of the big 2013 Easter Egg hunt at Nana and Gramps. Starring Olallie, Aticus, Jacob, and Shasta, the key players. Not great but much better than I thought it would turn out. Wish I had finished with a good ending. It has a watermark because I havent decided to buy the video software yet for $40.

WordPress.org vs. WordPress.com

In my mind, for any business or serious blogger WP.org is the obvious choice over WP.com. The power of open source code and access to 25,000 plugins via .org WP sites certainly outweighs the maintenance free slight advantage of .com WP. Here is a good graph created by WPMU.org showing the differences.

The future water sport

This video is absolutely amazing, bizarre and seems like something from the future. You have to watch it. Beginning is slow but have patience.

My Wounded Winnebago

My old 1986 Winnebago had a bit of a mishap back in November of last year. It was my last campout of the 2012 season. As I was leaving Colfax for the ocean, I stopped at the post office to get my mail, parking along the curb. What I didnt notice was a low hanging tree limb that bashed the right top corner of my baby just as I was pulling out. It broke my heart and was a huge cause for concern because there was a big storm coming in the following day. When i arrived at Wrights Beach (trip photos here) I immediately covered the gash with duct tape.

Turns out the patch worked and other than some tiny drips from the window, which were easily kept under control with a bowl and a towel, I weathered the storm and drove home in the rain without any water damage.

When I got home I went to Home Depot and bought a huge blue tarp to cover it thru the winter. Which worked out quite well. But now that the weather has warmed up and I am planning a trip back to Wrights Beach May 1st, I decided to tackle the fix up project.

One of the key pieces to the repair was finding the curved trim/molding metal piece that went around the corner and was totally messed up. I sent out emails to various RV salvage yards around the country and was lucky to get a response from Arizona RV Salvage in Phoenix. They had a whole bunch of these pieces with a cost of only $75 …. plus $120 shipping, gulp. Anyway.. I was thrilled to have found the part.

Since this is an old RV not worth a lot of bucks, I couldnt see spending a fortune to get it back to the original state but instead just really wanted to secure the shell so it was weatherproof and looked decent enough. I talked to a Paramount RV in Reno and they suggested all I would need is to use ProFlex caulk on the two big tears in the fiberglass combined with putting on the new trim piece. This was great news. However… when I removed the duct tape I saw what kind of mess had been covered up all this time. Totally shattered fiberglass in the corner.

When I took out the shattered pieces of plastic I found I had a big hole fill. Foam insulation worked well for that. Finally I made the decision to cut out the really bad area, replace it with a piece of aluminum, screw it in place, and caulk the torn areas.

So after painting … good enough! A little bit of frankenstein scars but what the heck. Not that noticeable and now weather proof and ready to go.

If there were only 100 people in the world

Here are some charts showing the distribution if there were only 100 people in the world. Some things to note:

- I wonder why French isn’t listed?

- What small minority we are in the USA 5%

- What a minority us older people over 65 are

- Only 7 would have a college education, surprising

- Almost evenly split between urban and rural dwellers

- A big majority, 78, have electricity

- 75 have cell phones!

- Almost half (48) live on <$2 USD/day

- 33 christians and 22 muslims, surprising, what about jews?

Are Bonds the next bubble?

Interest rates have been extremely low for a good 5+ years now. And we know its because of the Fed keeping the discount rate at zero and pumping free money into the sytem. But nothing goes on forever and I have to wonder is the bond market the next bubble. Look at all the other bubbles on this chart, while bonds have just been moving upward over the last 30+ years. Will we see 1% 30 year mortgages? I really doubt it but there are 2.5% 15 year mortgages now.

Weekly Indices are all up, up and away!

The S&P is 25 points away from its all time high at 1576, so it has yet to confirm the Dow record. However it put in a strong week and other than the ADX which is giving a cautionary signal, all seems well. The markets are up, not because the economy is so great but simply because the Fed keeps giving money the favored banks and they in turn inject it into the market since the rates are so low, bonds are not the place to be.

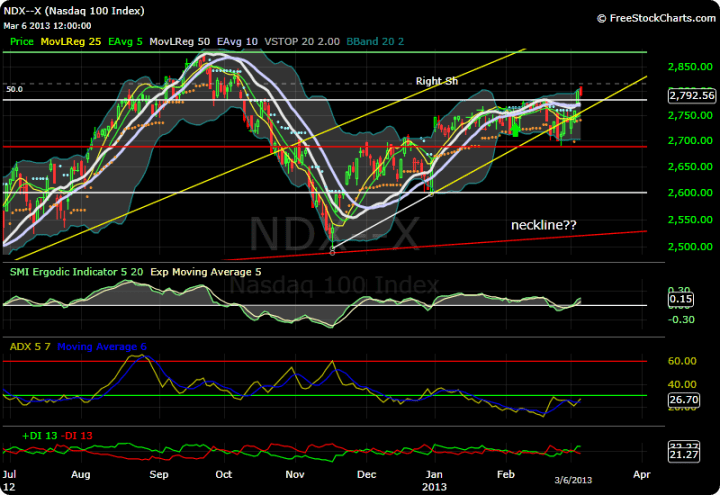

The Nasdaq definitely has not confirmed the dow record high but is way behind its 2000 record high. In fact it has yet to take out its Sept. 2012 high of 2878, which until it does, I consider that to be the head of the possible head and shoulders bearish formation. It is basically chopping around sideways with little momentum. Apple of course is a big drag on it, breaking below 400 this week for the first time in over a year.

The small caps measured by the Russell 2000 has confirmed the Dow and is making new highs. For a while I thought this was going to lead the pack down, however, it took off and has been leading on the upside. The only caveat here is the ADX roll over above the 50 mark. It has yet to cross over its moving average, but often this will precede a trend change by 1-3 weeks.

Other Stock Indexes Lagging the Dow

Even though the Dow has made new highs, and looks quite strong here at around 14,300, the S&P still has to exceed 1576 to take out its highs and its just at 1541. This lack of confirmation by the other indices is a bit of a warning not to be too exuberant and protective stops would be in order.

The Nasdaq 100 is nowhere near its highs of 4816 in March 2000 but more importantly its not even taken out its highs from last September 2878 and seems to have fallen back when it stuck its nose above 2800, closing today at 2792. The weekly chart still looks like a big Head and Shoulders pattern, quite bearish.

The Russell 2000 small caps has made new lifetime highs a couple weeks ago, but on this latest rally it has not been able to break above those and on a weekly chart it looks like its getting an ADX peak sell signal. This could come about in weeks or days but it will result in some sort of pull back.

ADP February Payroll Report

Here is a great infographic on the recent ADP payroll statistics, showing solid gains however not really enough to bring us back to much lower a much lower employment rate. February private payrolls grew 198,000 but that just keeps us from getting worse. We need over 250,000 to really make up for all the jobs lost.