Category: Trading

Charts and thoughts on the financial markets and trading.

End of the bull market?

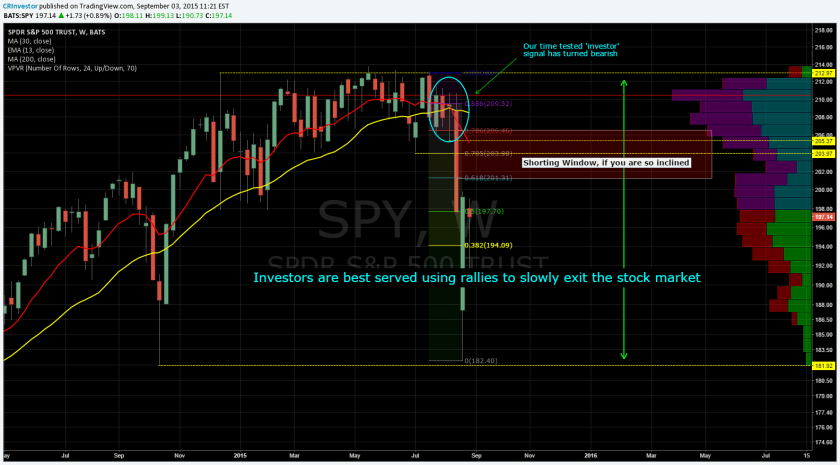

In August, in fact the week ended 8/21/2015, the market made a significant turn. The weekly indicators (moving averages, linear regression curves) turned bearish for the first time since 7/2011.

The Dow downside targets are 14,500-13,700 or as low as 11,000

S&P downside target 1560-1400

The SPY is the ETF that tracks the S&P and here is a chart with a suggested range for escaping or shorting.

Has Oil Bottomed?

Since everyone is watching the great gas prices of January, disappear I thought I would put up a chart on oil futures. My wife noted that she paid 2.19/gal for gas in January while now it is at 3.29 here in Colfax, CA. The downswing in oil has brought the price of MLPs down to the point where they are now yielding close to 7% (ETP Energy Transfer Partners LP at 6.86%). However with this 50% increase in gasoline you would think oil was rising dramatically. In fact, the energy sector may have bottomed (jury is still out on that) but it certainly has not come roaring back. Today West Texas intermediate crude is under $50 per barrel. I am following the ETF Direxion Energy Bull 3x ERX, and after a bounce in the first half of February it appears to be headed south again, similar to the oil futures (chart here).

Quotes from an article on theStreet.com:

“Just by oil getting 20% off its low, they think the sun has come back out and the birds are singing and it’s a wonderful time to own oil,” Evans said. “Meanwhile, the statistics show oil production hit its highest level since the early 1970s — a 40-year high — and is 15% higher than a week ago.”

Crude oil inventories are the highest in 84 years, since 1931. The U.S. Dept. of Energy weekly inventory series dates from 1982, so analysts making that comparison are looking at an older, monthly data series from a different source, he noted.

Inventories of 444.4 million barrels are 80.6 million barrels, or 22.1% higher than a year ago and 89.5 million barrels, or 25.2%, above the five-year average level.

The first is a daily chart of ERX

Interactive Intraday Chart – Just enter the ERX symbol in the box below

Stock Market Sell Signal

Today I got the sixth sell signal of my long term indicators. This marks six out of six indicators all pointing down, a rare occasion. These include long term as well as short term indicators. Both the Nasdaq and S&P have broken thru support, including a major up trendline on the Nas. On a monthly (long term) basis the Nas indicates way overbought and past due for a correction. The Nas could easily drop 400 points before stopping. If the S&P breaks below 1800ish it could drop another 300 points. Strap on your seat belts for a wild ride.

UPDATE 10/23 ... the 6/6 sell signal has aborted today. the short term indicators have turned bullish, so until they turn down again, there is no 6/6 sell signal. I am thinking of adding longer term indicators ie; weekly and monthly charts (which at this point are still holding bullish).

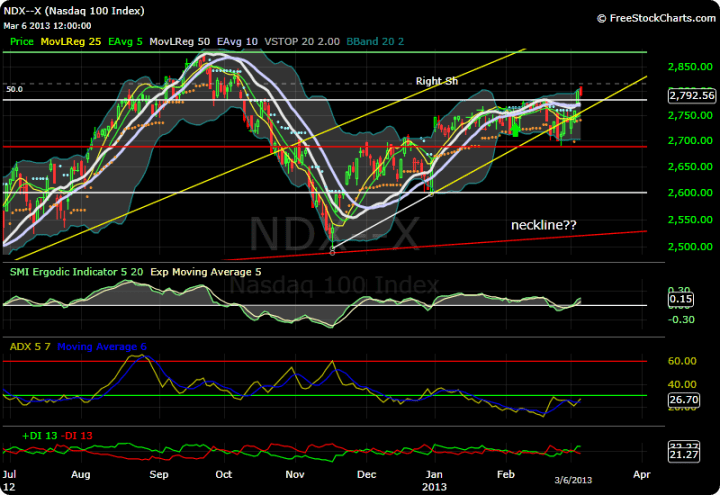

Nasdaq 100 due for correction

The Nasdaq 100 has gone from 1040 to over 3600 since 3/09, just less than 5 years. Looking at the monthly chart, the ADX shows it’s in dangerous territory, overbought and due for a correction. But before taking profits or shorting I would be looking for the ADX to cut down from this level, the ergodic to crossover down, and the orange ball to be taken out with a monthly close below 3300 signaling the correction is in play. Target range 2000-2500.

[subscribe2]

New Highs (again) on the S&P. Will it ever end?

The S&P continued toward my target in the 1600 area, in fact I believe it hit the 1.618 Fibonacci move today and could retrace from here. Several indicators of that possibility. It is way beyond its upper Bollinger Band, it is possibly forming its third bearish divergence against the Ergodic momentum indicator, and it has touched and turned back at the top of the up channel as you can see in the chart. Another cautionary item to note is the non-confirmation by the Nasdaq 100 and the Russell 2000, neither making new highs here. Soooo I would make an educated guess that the market will find some reason to pull back from here. Now how big of a correction … I don’t know but May is right around the corner and statistically it has been wise to sell in May and go away. The market is setup for this classic traders almanac rule of thumb, to come true this year. On the other hand, the Fed is a long way from ending its QE so this market is in no way normal. In fact, its an example of the new normal.

Are Bonds the next bubble?

Interest rates have been extremely low for a good 5+ years now. And we know its because of the Fed keeping the discount rate at zero and pumping free money into the sytem. But nothing goes on forever and I have to wonder is the bond market the next bubble. Look at all the other bubbles on this chart, while bonds have just been moving upward over the last 30+ years. Will we see 1% 30 year mortgages? I really doubt it but there are 2.5% 15 year mortgages now.

Weekly Indices are all up, up and away!

The S&P is 25 points away from its all time high at 1576, so it has yet to confirm the Dow record. However it put in a strong week and other than the ADX which is giving a cautionary signal, all seems well. The markets are up, not because the economy is so great but simply because the Fed keeps giving money the favored banks and they in turn inject it into the market since the rates are so low, bonds are not the place to be.

The Nasdaq definitely has not confirmed the dow record high but is way behind its 2000 record high. In fact it has yet to take out its Sept. 2012 high of 2878, which until it does, I consider that to be the head of the possible head and shoulders bearish formation. It is basically chopping around sideways with little momentum. Apple of course is a big drag on it, breaking below 400 this week for the first time in over a year.

The small caps measured by the Russell 2000 has confirmed the Dow and is making new highs. For a while I thought this was going to lead the pack down, however, it took off and has been leading on the upside. The only caveat here is the ADX roll over above the 50 mark. It has yet to cross over its moving average, but often this will precede a trend change by 1-3 weeks.

Other Stock Indexes Lagging the Dow

Even though the Dow has made new highs, and looks quite strong here at around 14,300, the S&P still has to exceed 1576 to take out its highs and its just at 1541. This lack of confirmation by the other indices is a bit of a warning not to be too exuberant and protective stops would be in order.

The Nasdaq 100 is nowhere near its highs of 4816 in March 2000 but more importantly its not even taken out its highs from last September 2878 and seems to have fallen back when it stuck its nose above 2800, closing today at 2792. The weekly chart still looks like a big Head and Shoulders pattern, quite bearish.

The Russell 2000 small caps has made new lifetime highs a couple weeks ago, but on this latest rally it has not been able to break above those and on a weekly chart it looks like its getting an ADX peak sell signal. This could come about in weeks or days but it will result in some sort of pull back.

VIX Market Buy Signal

Yesterday gave a confirmed VIX buy signal. The last four of these signals have delivered the goods, however, the last confirmed sell signal took two weeks before a dip and that wasnt even to the level of when it occurred. The chart below is courtesy of Springheel Jack.