In August, in fact the week ended 8/21/2015, the market made a significant turn. The weekly indicators (moving averages, linear regression curves) turned bearish for the first time since 7/2011.

The Dow downside targets are 14,500-13,700 or as low as 11,000

S&P downside target 1560-1400

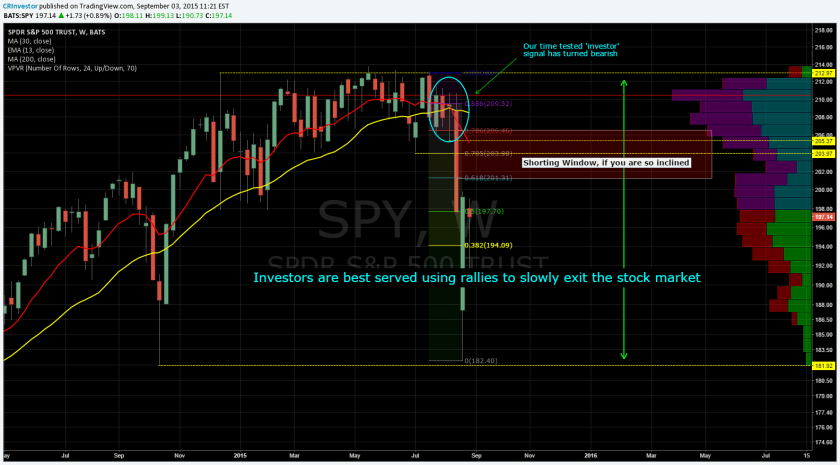

The SPY is the ETF that tracks the S&P and here is a chart with a suggested range for escaping or shorting.